Cloud Computing in China

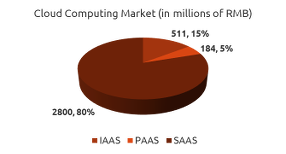

Cloud Computing Market 2012 - RMB 3.5 billion

- SaaS - RMB 2800 million

- IaaS - RMB 573 million

- PaaS - RMB 184 million

As part of series of article covering my talk in BarCamp and susequently in OpenStack Summit, I covered What is Cloud Computing in my earlier article, in this article I will cover up the remaining topics:

- What is cloud computing officially in China?

- Current state and market analysis of cloud computing in China

- Regulatory framework for cloud computing in China

- Factors affecting cloud computing in China

- Future of cloud computing in China

China home to over 500 million internet users with over 242 million eCommerce users (according to CNNIC [1]) and with online shopping transactions volume expected to reach 1.85 trillion yuan (US$ 302 billion) in 2013; it is natural to expect that Cloud Computing in China will follow similar growth given the economy of scale, flexibility and cost advantage it offers. But like anomalies in other industries, Cloud Computing is a nascent industry in China with a very limited market share and appeal to enterprises. Also due to current prevailing regulations in China, it becomes much harder to transform and bring innovation, as the new regulations inline with technological progress are still under discussion. In China Cloud Computing is adopted by few internet companies for internal use, as it is virtually impossible for foreign companies to offer Cloud Computing Services, unless new regulatory revisions are made. Even for local technology companies and startups it is virtually impossible to built innovative Cloud Computing services, given the necessity of approvals and licenses required. These regulatory and licensing challenges combined with business challenges makes it cost prohibitive and expensive to operate Cloud Computing Services; taking away the flexibility, economy of scale and cost advantages; the basic tenets of Cloud Computing.

In spite of all these challenges, there is light at the end of the tunnel and in 2012 the total cloud computing services market was approximately 3.5 billion yuan (US$ 573 million) and expected to increase by 30% this year. This figure needs to be taken with a grain of salt as there are multiple interpretations of Cloud Computing in China.

Cloud Computing definition covered in my previous article What is Cloud Computing is generally accepted definition and covers all aspects of Cloud Computing. In China there are multiple version of Cloud Computing definitions.

Cloud Computing Definition in China

There is no generally accepted definition in China and among multile version the most prominent version according to The Ministry of Industry and Information Technology (MIIT) [2] is:

Cloud computing is a method for achieving large-scale computing information processing, which unifies, organizes, and flexibly draws upon various Information and Communication Technology (ICT) information resources through the Internet. Cloud computing utilizes distributed computing and virtual resource management technologies, among others. Using the Internet, it takes spread-out ICT resources (including computing, storage, application platforms, and software, among others) and brings them together to form a shared resource pool. Furthermore, it uses dynamic, on-demand, and scalable methods to provide services to users. Users can use various types of terminals (such as personal computers (PCs), tablet computers, smart phones, even smart televisions, among others) to access ICT resource services through the Internet.

If you read through the definition, it mostly matches the generally accepted definition except “on-demand self service”. This part is left out due to requirement of ICP (Internet Content Provider) license in China. Since ICP license is linked to computing resources like domain name, IP addresses (external accessible through internet); it makes it challenging if not impossible to provide elasticity, auto-scaling, movement of computing resources based on application and user demands (since it needs some human interaction and not an automated process).

This is not the only definition in China and there are some other definitions as well. Some of them are same as NIST like this one from Advisory Committee for State Informatization - ACSI (国家信息化专家咨询委员会) which defines: “Cloud computing is a model for enabling ubiquitous, convenient, on-demand network access to a shared pool of configurable computing resources (e.g., networks, servers, storage, applications, and services) that can be rapidly provisioned and released with minimal management effort or service provider interaction.”, in one of their presentation.

ICP License [13]

ICP license application process and approval is manual multi-step process involving regulatory authorities and is described briefly here. This license is required by both local foreign enterprises in China for Internet based application and services.

- You need to create an account at Ministry of Industry & Information Technology by entering your e-mail address and cell phone number .

- After the approval by the MII, you will receive a confirmation code on your cell phone and e-mail account.

- After receiving the code you have to login into the MII website, enter the code, and access your account.

- After login into the MII Web site need to fill an on-line form with name, mobile phone number, home phone number, home address, domain name, host provider, company name, and description of website.

Usually this process can take from 20 days to 90 days and if you change the cloud provider you need to go throught the process again for approval.

China Cloud Computing Market Analysis

In China like other countries its difficult to find reliable market report for Cloud Computing Services. Also given the way its defined many reports add server virtualization market into Cloud Computing (which inflates the figure and give a wrong impression of the Cloud Computing Market in China). Still based on some estimates following are some of the findings for the China’s Cloud Computing market.

In 2012 the market size for Cloud Computing in China is approximately 3.5 billion yuan (US$ 573 million) which compose of:

- Software as a Service (SaaS) - 2800 million yuan (US$ 459)

- Infrastructure as a Service (IaaS) - 511 million yuan (US$ 83.77 million)

- Platform as a Service (PaaS) - 184 million yuan (US$ 30.16 million)

Among all the cloud providers SaaS only covers 16% and remaining 84% are primarily IaaS providers with few PaaS providers. This means majority of the revenue for Cloud Computing comes from SaaS providers, which is inline with the market reality, since majority of the revenue is generated by companies like Alibaba with its marketplace (Tmall and Taobao), Tencent with its Weixin (WeChat) platform and Sina with its Weibo platform. Some might question that Taobao, Tencent and Sina generate much larger revenue, but if they look closely at revenue the portion of revenue from pure SaaS service is very small and majority comes from other means like advertising, payment and games.

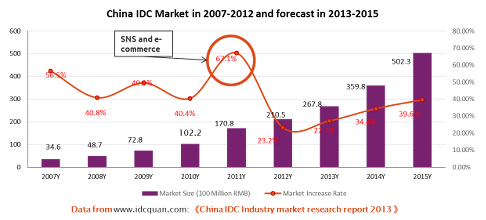

Since Cloud Computing depends on the underlying data center, the above figure shows market size and trends for internet data center in China. Since Internet Data Center license is prohibited for local and foreign enterprises since 2008 in China. the growth has been slow. Please take above figures for reference only, like Cloud Computing, I cannot verify the validity of figures from reliable data sources. It seems most of this figures are derived based on a limited survey.

There are few counts and reports available from Netcraft, but I did not include it in this article since they do not accurately depict the market and tend to skew towards large telecom and internet companies in China, which does not reflect the normal Cloud Computing market.

Regulatory Framework and factors affecting Cloud Computing in China

After detailed analysis of China Cloud Computing market, the factors inhibiting its growth can be summarized with one word Regulations. In China there is no specific regulation or license which directly address Cloud Computing in China. Since Cloud Computing uses Internet network to access services, it is regulated based on the China Telecommmunication Regulations [3] and ususally classified as Value Added Telecommunication Services (VATS). So it creates a high regulatory barrier to entry even for local innovative companies and startups (since for foreign companies if not prohibited mostly limited to non-controlling stakes). So in my view in China Cloud Computing is not hampered by technology related issues, but more due to regulatory issues. During my discussion and talks within local technology companies and startups I find many are technically at par with leading cloud computing companies globally but cannot execute it locally due to high barrier to entry set by current regulatory framework.

Following are some of the key regulatory framework covering Cloud Computing in China:

Cloud Computing is governed by Circular of the Ministry of Information Industry on the Readjustment of the Classification Catalogue of Telecommunication Services (信息产业部关于重新调整-电信业务分类目录-的通告) - 2003 Classification Catalogue [4] and usually classified as VATS.

Cloud Computing Service providers which needs to provision Internet Data Center (IDC) services or built an IDC to deliver Cloud Computing Services needs an IDC Service license. IDC license are currently not granted to either local or foreign enterprises since 2008. Recently IDC license are accepted from local enterprises in 2013. Also foreign enterprises in China cannot get IDC license and normally use Variable Interest Entity (VIE) structure or partnership with local firms.

The services which do not fall within 2003 Classification Catalogue will only need to file and record case with the provincial counterparts of the MIIT before commercially operating the services. But in practice at present, no specific procedures are in place to fulfill such record-filing requirements and information about successful cases of record-filing are not available publicly.

- Foreign company must establish a Foreign Invested Telecommunication Enterprise (FITE) in China to provide Cloud Computing Services to local companies and consumers. They need to follow:

- Catalogue of Industries for Guiding Foreign Investment (外商投资产业指导目录) [5]

- Telecommunication Regulations, the Provisions on Administration of Foreign-Invested Telecommunications Enterprises (外商投资电信企业管理规定) [6]

- Portion of foreign investment in Basic Telecom Service (BTS) (applicable if providing IDC services) should not exceed 49%. This means FITE needs to form a joint venture with local Chinese entity having the majority controlling stake.

- Portion of foreign investment in VATS type FITE should not exceed 50%, which means a joint venture with equal stack for FITE and local Chinese entity.

In most cases foreign enterprise will most likely provide Cloud Computing services under VATS, the followin additional requirements needs to be considered (these are same for local Chinese entity applying for VATS license):

- The proportion of capital invested by the foreign company shall not exceed a total of 50%.

- The registered capital should be either RMB 10 million or more for nationwide service in China.

- The foreign investor shall have a record of good performance and operating experience in managing value-added telecommunications business.

- FITE employs minimum of 10 employees at the time of application.

Obviously these regulationa creates a big barrier for most of the startups or small companies to enter Cloud Computing Services market and make it extremely hard for large enterprises to enter. Moreover based on information available only 28 FITE’s managed to get a license since 2003 in China. So based on this information majority of the Chinese small and medium sized Cloud Computing Service providers and most of the foreign Cloud Computing Services Providers operate under grey zone or without license in the hope regulations will evolve.

Future of Cloud Computing in China

China recognize the importance of Cloud Computing for Information Technology and identified it as key strategic industry for technological progress of China. According to some industry analysts China’s Cloud Computing industry value chain will be between 750 billion yuan to 1 trillion yuan (US$ 123 billion to US$ 164 billion). China’s central state council and various ministries provided support for development and investment in Cloud Computing technology through following major planning documents:

- China’s National Medium and Long-Term Plan for Science and Technology Development [7]

- China’s 12 th Five Year Plan (FYP) for Economic and Social Development [8]

- Ministry of Science and Technology 12 th FYP [9]

- Software and Information Technology Service Industry Development Plan for the 12 th FYP (软件和信息技术服务业“十二五”发展规划) [10]

- Support Project for Next-Generation Information Technology Application Security (新一代信息技术应用安全支撑工程) [11]

Besides government planning document and investment, China is also working on revising regulatory framework to make it inline with market needs and create an environment necessary for proliferation of Cloud Computing technology and services.

- Amendments to 2003 Classification Catalogue

MIIT circulated an updated version 2013 Draft Classification Catalogue to solicit public comments on 25 th May 2013. This new catalogue did not add Cloud Computing Service category, but introduced a new category named Internet Resources Collaboration Services which refers to the use of equipment and resources constructed on data centers, and through the internet or other networks, to provide customers with services, including, data storage, development environment for internet applications, deployment of internet applications and operation management to users by way of easily accessible, use on-demand, easily expanded and/or collaborative sharing which covers the Cloud Computing Services.

Above amendment will enable foreign entities to offer Cloud Computing Services in China.

MIIT lifted ban on IDC by a notice [12] on 30 th November 2012 and recently granted license to Huawei and Alibaba.

Also due to inherent requirements for serving over 500 million internet users in China, most of the internet companies, enterprises and startups are embracing and developing cloud computing technology for internal use.

Conclusion

In essence Cloud Computing Services in China despite all the hurdles is poised to take off in a big way. Since it is fundamental for serving millions of Internet users cost effectively and flexibly. Also since the regulatory framework is evolving I expect more Cloud Computing service providers in market with innovative and mature compute, storage and network related Cloud Computing services at attractive prices. Also more foreign players will be available in China, like Microsoft is doing a beta test with its Azure services in China. In this article I intentionally left the current Cloud Computing Service providers in China since many of them are still operating in grey zone or enjoying a monopoly due to regulations and not due to innovation in technology or Cloud Computing service offerings. Moreover I only have first hand experience of using Cloud Computing Services from two large players which is not representative of the overall market. So I will do bit more research and work with local Cloud Computing providers and cover them in next article. If you are a Cloud Computing Service provider in China and would like to be included in my next article, please send me mail with the details of your Cloud Computing Services. Hopefully information in this article is useful for some people, and if you notice some issues please notify me for corrections.

Footnotes

| [1] | The 31st Survey Report |

| [2] | The Ministry of Industry and Information Technology’s Cloud Computing White Paper 2012 (云计算白皮书) |

| [3] | China Telecommunications Regulations (中华人民共和国电信条例) |

| [4] | 2003 Telecommunication Services Catalogue - 信息产业部关于重新调整《电信业务分类目录》的通告 |

| [5] | Catalogue of Industries for Guiding Foreign Investment (外商投资产业指导目录) |

| [6] | Telecommunication Regulations, the Provisions on Administration of Foreign-Invested Telecommunications Enterprises (外商投资电信企业管理规定) |

| [7] | China’s National Medium and Long-Term Plan for Science and Technology Development 2006-2020 (国家中长期科学和技术发展规划纲要) |

| [8] | China’s 12th Five Year Plan (FYP) for Economic and Social Development |

| [9] | Ministry of Science and Technology 12th FYP (新一代信息技术) |

| [10] | Software and Information Technology Service Industry Development Plan for the 12th FYP |

| [11] | Next-Generation Information Technology Application Security |

| [12] | Regulating the Market Access of Internet Data Center Service and Internet Access Service (工信部关于进一步规范因特网数据中心业务和因特网接入服务业务市场准入工作的通告) |

| [13] | ICP License Process (in Chinese) |